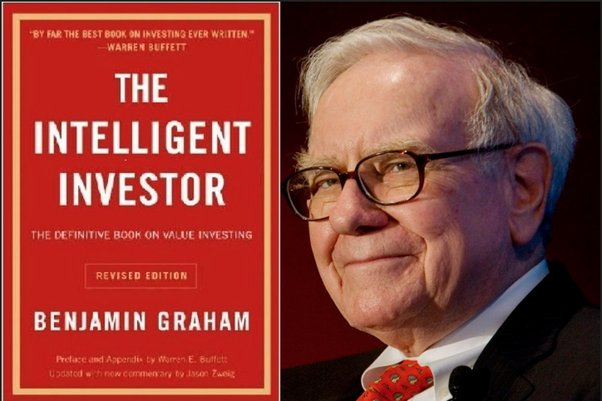

Have you ever wanted to learn these 7 Lessons from about the investment industry but been intimidated by technical terms and concepts? The timeless classic “The Intelligent Investor” by Benjamin Graham can assist explain the intricacies of the stock market and offer insightful advice on creating a profitable investing plan. We’ll dissect seven essential takeaways from the book in this blog post using easy-to-understand language.

1: Investing versus Speculating.

Graham makes a distinction between speculation and investing. Speculating is more like gambling because it depends on short-term market swings, whereas investing entails in-depth study and a focus on long-term value. A wise investor needs to recognize the difference and give sound basic investments priority over speculative ventures that promise quick riches.

2: Safety Margin.

The “margin of safety,” which highlights the significance of purchasing assets at a sizable discount to their true worth, is one of Graham’s most well-known ideas. Investors safeguard themselves against unanticipated dangers and market downturns by taking this action. To reduce possible losses, try to purchase equities at a discount to their actual value.

3: Market and 7 Lessons from.

Graham presents the metaphor of “Mr. Market,” a fictional figure who makes daily proposals to purchase or sell stocks at different prices. Mr. Market can be logical and reasonable at times, or he might be unduly gloomy or hopeful. Efficient investors should capitalize on the fluctuations in Mr Market’s attitude by purchasing at low prices and disposing of assets at high ones.

4: The Enterprising vs. the Defensive Investor.

Investors can be classified into two groups by Graham: adventurous and defensive. Whereas the entrepreneurial investor is more active, looking for cheap companies and doing market research, the defensive investor favours a more passive strategy, concentrating on low-cost index funds and limiting risk. Whichever method you choose, it’s critical to match your investment plan to your financial objectives and risk tolerance.

5: Increasing Variety.

Graham highlights the significance of diversification in lowering portfolio risk. you can learn here 7 Lessons Your portfolio is more likely to expand overall and you can lessen the impact of individual stock losses by spreading your investments across a variety of asset classes and industries. Diversification should never, however, take the place of careful consideration and evaluation of each investment.

6: Variations in the Market.

Graham suggests that when dealing with market volatility,7 Lessons from investors should adopt a logical approach. Focus on the core principles of your investments rather than losing your cool in downturns or being unduly excited in bull markets. Keep in mind that market prices don’t necessarily correspond to fundamental worth, and you shouldn’t let short-term volatility discourage you from following through on your long-term investment plan.

7: The Personality of the Investor.

Graham concludes by highlighting the value of moral qualities like self-control, perseverance, and patience in successful investing. Refrain from giving in to fear and greed, or from being influenced by market hype. Rather, keep an analytical mindset based on solid concepts and adhere to your investing plan through hardships 7 Lessons from in this blog you will check out.

Table of Contents

Finally, Benjamin Graham’s “The Intelligent Investor” provides timeless guidance to help investors of all stripes navigate the ups and downs of the stock market. You can establish a strong basis for long-term financial success by comprehending fundamental ideas like the difference between investing and speculating, the margin of safety, and the significance of diversification. As long as you maintain your composure, discipline, and attention to the basics, you should have no trouble developing into a knowledgeable investor.